First, the word is out. According to the EIA, the US was the world’s leading oil producer for the 6th straight year in 2023 producing 12.6 million barrels per day.

It is common for people to blame rising US gasoline and diesel prices only on restrictions in crude oil production and alleged government regulatory overreach. Indeed, pressure on the gas and oil supply side or even just the threat of it can lea to unstable retail gasoline and diesel prices. What is less appreciated is the role of petroleum refineries on prices. To be sure, there is always price speculation on both the wholesale and retail sides of gas and diesel pricing to consider no matter the throughput. Like everywhere else, sellers in the petroleum value chain seek to charge as much as they possibly can 24/7/365. Everyone is itching to charge more but are hindered by competition and risk.

Refineries are only one of several bottlenecks in the gasoline and diesel supply chain that can influence retail prices. In principle, more gas and oil can always be produced at the wellhead by increased exploration or increased imports. Even so, there are constraints on transporting crude to refineries. Pipelines have flow rate limitations and storage tank farms and ocean tanker fleets all have finite capacity. Another bottleneck today is access to both the Suez and Panama canals. Suez Canal traffic is threatened by Houthi missile strikes on commercial shipping in the Red Sea and the Panama Canal seems to be drying up. The result is increased shipping costs and delays for international transport which the consumer will have to bear.

What do refineries do?

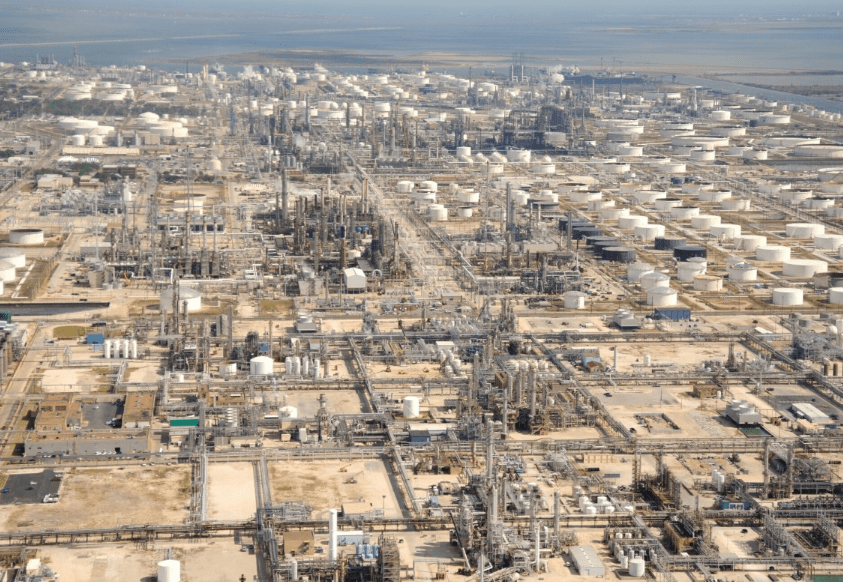

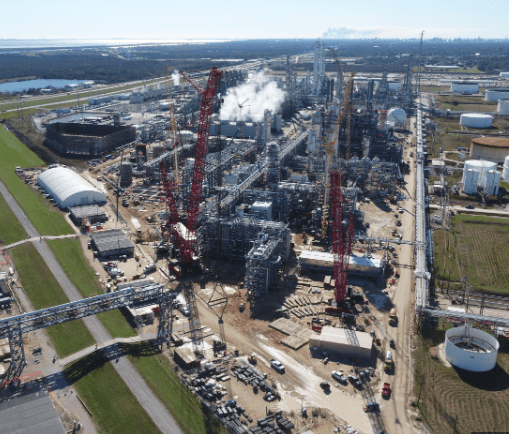

Refineries are very special places. Within the refinery there is 24/7 continuous flow of large volumes of highly flammable liquids and gases that are subjected to extreme temperatures and pressures for distillation, cracking, alkylates, hydrogenations and reformates. The whole refinery is designed, built and operated to produce the fastest and highest output of the most valuable group of products- fuels. This group would include gasoline, diesel, aviation fuel, and heating oil.

Petrochemicals account for approximately 17 % or refinery output. These petrochemical streams account for pharmaceutical raw materials, polymer products, coatings and films, synthetic fibers, personal hygiene products, synthetic rubber, lubricating grease and oils, paint, cleaning products and more. Regardless of what we may think of plastics and other synthetic materials, the 17 % produced by refineries feeds a very large fraction of the global economy. If plastic bags went away overnight, the whole world would begin to search immediately for alternatives like wood, metal or cotton/wool/flax/hemp.

Occasionally technological challenges confront refineries. An early challenge was the production of high octane anti-knock gasoline. This was investigated thoroughly as early as the 1920’s as the demand for more powerful automotive and aircraft engines was rising. Luckily for the USA, UK, and Germany, the anti-knock problem was solved just prior to WWII. This breakthrough led to aircraft engines with substantially increased power per pound of engine weight.

Leaded Gas

The petroleum that goes into gasoline is naturally rich in a broad range of straight chain hydrocarbon molecules. Straight chain hydrocarbons were used in the early days of happy motoring, but the engine power remained low. While these straight chain hydrocarbons have valuable heat content for combustion, the problem with these molecules is that in a piston engine, they cannot withstand the pressures in the compression stroke that would give greater power. To get maximum power from a gasoline engine, it is desirable to have the piston move up and down as far as possible for maximum power delivery to the crankshaft. However, a long stroke length means greater compression and higher pressure near the top of the compression stroke. Straight chain hydrocarbons could not withstand the higher pressures coming from the compression stroke and would detonate prior to reaching top of the cycle. This effect results in knocking or destructive pre-detonation with power loss.

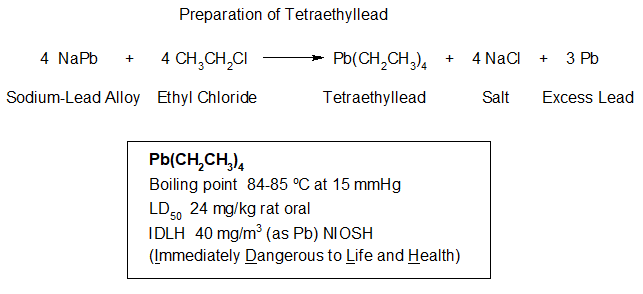

Tetraethyllead was invented in 1921 by Thomas Midgley, Jr, working at General Motors. After some deadly and dissatisfying work by DuPont, General Motors and Standard Oil Company of New Jersey started the Ethyl Gasoline Corporation in 1924, later called Ethyl Corporation, and began to produce and market tetraethyllead. Within months of startup, the new company was faced with cases of lead poisoning, hallucinations, insanity and fatalities.

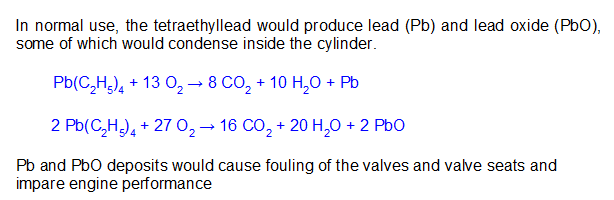

The first commercially successful fuel treatment to prevent this pre-detonation was tetraethyllead, (C2H5)4Pb, produced by Ethyl. This is the lead in “leaded” gasoline. The use of (C2H5)4Pb began before WWII and just in time to allow high compression aircraft engines to be built for the war. It allowed for higher powered aircraft engines and higher speeds for the allies which were applied successfully to aerial warfare. The downside of (C2H5)4Pb was the lead pollution it caused. Tetraethyllead is comprised of two chemical features- lead and 4 tetrahedrally arranged ethyl hydrocarbon groups. The purpose of the 4 ethyl groups (C2H5) on (C2H5)4Pb was their ability to give hydrocarbon solubility to a lead atom. It was the lead that was the active feature of (C2H5)4Pb that brought the octane boosting property. At relatively low temperature the ethyl groups would cleave from the lead leaving behind a lead radical, Pb., which would quench the combustion process just enough to allow the compression cycle to complete and the spark plug to ignite the mixture as desired.

While tetraethyllead was especially toxic to children, it was also quite hazardous to (C2H5)4Pb production workers. Its replacement was only a matter of time.

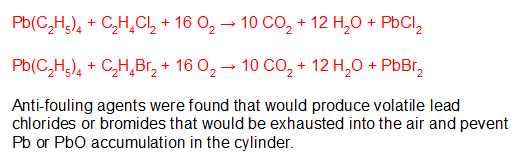

Fuel additives were found that would reduce engine fouling by scavenging the lead as PbCl2 or PbBr2 which would follow the exhaust out of the cylinder. While this was an engineering success, it released volatile lead products into the atmosphere.

Eventually it was found that branched hydrocarbons could effectively inhibit engine knock or pre-detonation and could replace (C2H5)4Pb … which it did. While lead additives have been banned for some time from automotive use, general aviation has been allowed to continue with leaded aviation gas (avgas) in light piston engine aircraft like 100 octane low lead (100LL). Only recently has leaded avgas become a matter of public concern.

A refinery not only engineers the production of fuel components, it must also formulate blends for their customers, the gas stations, to sell. The formulations will vary with the season and the location. Some gasolines have ethanol, other oxygenates like MTBE, octane boosters, detergents and more. One parameter is the volatility of the fuel. When injected into the cylinder, it must evaporate at some optimum rate for best fuel efficiency. This will depend on the vapor pressures of the components.

Back to Refineries

The production volumes of the individual fuel products will not match the contents of the crude oil input. Gasoline is the most valuable product, but more gasoline leaves the refinery than arrives in the crude. Any given grade of gasoline has many, many components and the bulk of them have somewhere around 8 carbon atoms in the hydrocarbon chain. Wouldn’t it be nice if longer hydrocarbon chains could be broken into smaller chains to be added into the gasoline mix? And guess what, that is done by a process called “cracking”. A piece of equipment called a “cat cracker” uses a solid ceramic catalyst through which hot hydrocarbon gases pass and get cut into smaller fragments.

But what about straight chain hydrocarbon molecules? Wouldn’t it be nice to “reform” them into better and higher octane automotive fuels? There is a process that uses a “reformer” to rearrange hydrocarbon fuels to give better performance. The products from this process are called reformates.

Reforming is a process that produces branched, higher-octane hydrocarbons for inclusion in gasoline product. Happily, it turns out that gasoline with branched hydrocarbons are able to resist pre-detonation and have come to replace tetraethyllead in automotive fuels entirely. Today we still refer to this lead free gasoline product as “unleaded”.

Octane and Cetane Ratings

Octane rating is a measure of resistance to pre-detonation and is determined quantitatively by a single-cylinder variable compression ratio test engine. Several octane rating systems are in use. RON, the Research Octane Number, is based on the comparison of a test fuel with a blend of standard hydrocarbons. The MON system, Motor Octane Number, covers a broader range of conditions than the RON method. It uses preheated fuel, variable ignition timing and higher engine rpm than RON.

Some gasoline is rated in the (R + M)/2 method which is the just average of the RON and MON values.

In both the RON and MON systems, the straight chain hydrocarbon standards are n-heptane which is given an octane rating of 0 and the branched hydrocarbon 2,2,4-trimethylpentane, or isooctane, which is given an octane rating of 100.

Tetraethyllead and branched hydrocarbons are octane boosters. Methyl tert-Butyl Ether (MTBE), ethyl tert-butyl ether, and aromatics like toluene are also used to boost octane values. Internal combustion engines are built to use a gasoline with a minimum octane rating for efficient operation. A rating of 85 or 87 are often the octane ratings of common “unleaded” gasoline. Higher compression ratio engines require higher octane fuel- premium grade -to avoid knocking.

For comparison, diesel has a RON rating of 15-25 octane so it is entirely unsuitable for gasoline engines. Diesel has its own system called the Cetane rating. The Cetane Number is an indicator of the combustion speed of the diesel and the compression needed for ignition. Diesel engines use compression for ignition unlike gasoline engines which use a spark. Cetane is n-hexadecane which is a 16-carbon straight chain with no branching. Cetane is given a Cetane Number (CN) of 100. Similar to the Octane rating, the branched 16-carbon hydrocarbon heptamethylnonane, or isocetane, is given a CN of 15. Included in the Cetane number.

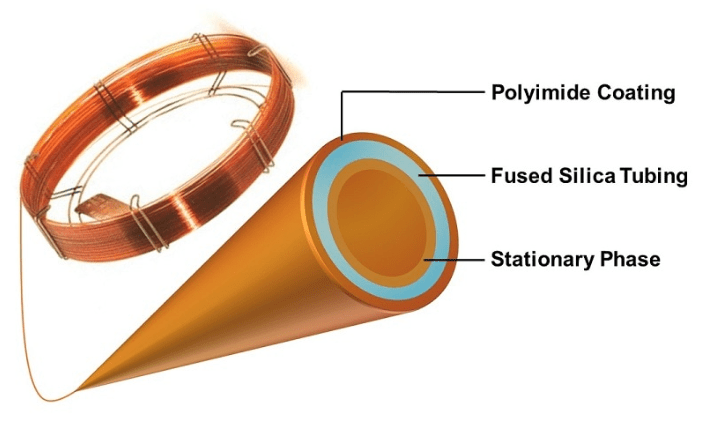

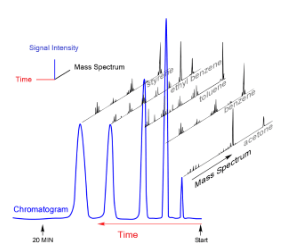

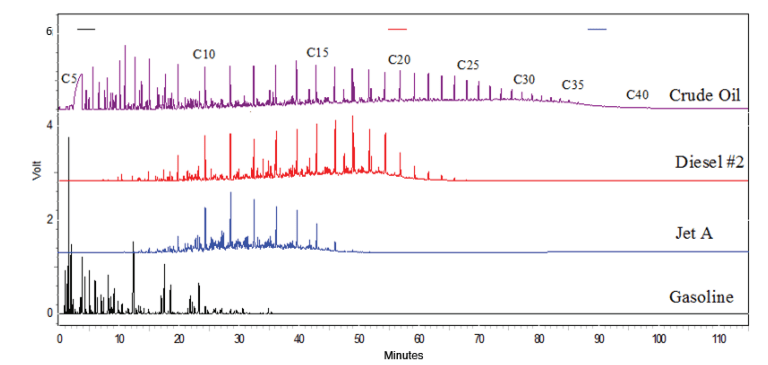

Refineries must keep close tabs on seasonal demand for their various cetane and octane-rated products as well as the composition of the crude oil inputs which can vary. Each gasoline product stream has performance specifications for each grade. While gasoline is a refined product free from water, most sulfur and solid contaminants, it is not chemically pure. It is a product that contains a large variety of individual hydrocarbon components varying by chain length, branching, linear vs cyclic, saturated vs unsaturated members that together afford the desired properties.

Specific Energy Content

Absent ethanol, the combustion energy values of the various hydrocarbon grades are so similar as to be negligeable. The energy content of pure ethanol is about 33 % lower than gasoline. Any energy differences would be due to subtle differences in blending to achieve the desired octane rating or proprietary additives like detergents. A vehicle designed to run on 85 octane will not receive a significant boost in power with 95 octane unless it is designed to operate on higher octane fuel.

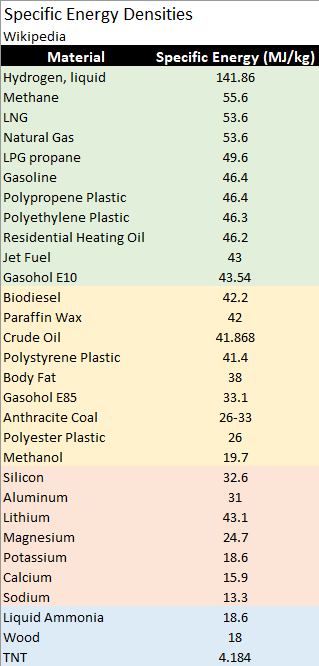

From the Table above and looking at the polypropylene (PP) and polyethylene (PE) entries then comparing to gasoline, we see that the specific energies are the same. The two polymers and gasoline are saturated, hydrocarbons so it is no wonder they have the same specific energies. Polystyrene is a bit lower in specific energy because the hydrogen content is lower, reducing the amount of exothermic H2O formation as it burns. The point is that by throwing away millions of tons of PP or PE every year, we are throwing away a whopping amount of potential fuel for combustion and electrical energy generation.

Petroleum based liquid fuels burn readily because of their high vapor pressure and low flash points. Polyolefins like PP and PE by contrast have virtually no vapor pressure at room temperature and consequently are difficult to ignite. In order to burn, polyolefins need to be thermally cracked to small volatile fragments in order to provide enough combustible vapor for sustained combustion. Plastic fires tend to have an awful smell and dark smoke because the flame does a poor job of energizing further decomposition to vapor.

Going from E10 to E85, the specific energy density drops considerably from 43.54 to 33.1 MegaJoules per kilogram (MJ/kg). Replacing a significant quantity of gasoline with the already partially oxidized ethanol lowers the potential energy. In the tan colored section, we can see the elements silicon to sodium. These elements are either very oxophilic or electropositive and release considerable heat when oxidizing. Some metals amount to a very compact source of readily oxidizable electrons.

Refinery Troubles

According to the US Energy Information Agency (EIA) US refinery output in the first quarter of 2024 has dropped overall by 11 % and has fallen as low as 81 % utilization. Decreasing inventories are causing rising retail prices. Still, average gasoline and diesel prices are currently below the same time period in 2023.

According to EIA, the US Gulf Coast has seen the largest 4-week average drop in refinery utilization at 14 % since January, 2024. This is attributed in part to the early start of maintenance shutdowns of Motiva Port Arthur and Marathon Galveston Bay refineries which account for 7 % of US capacity.

Weather has factored-in this year as refinery production was halted in several locations in the US. A severe winter storm shut down the TotalEnergies’ 238,000 barrel-per-day refinery in Port Arthur, Texas.

Oil production in North Dakota fell to half. Oil production was estimated to have fallen between 600,000 and 650,000 barrels per day.

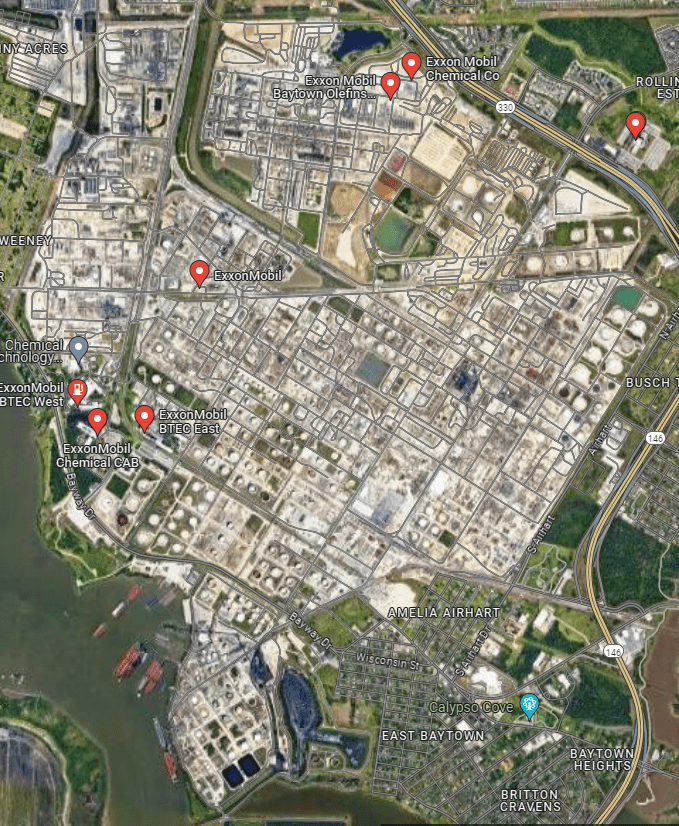

Exxon Mobil Corp returned a fluidic catalytic cracker and a coker to normal operation at its 564,440 barrel per day refinery in Baytown, Texas.

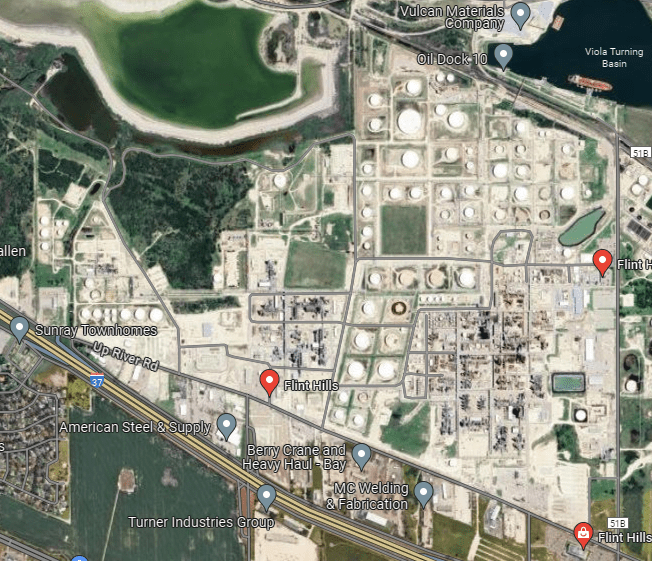

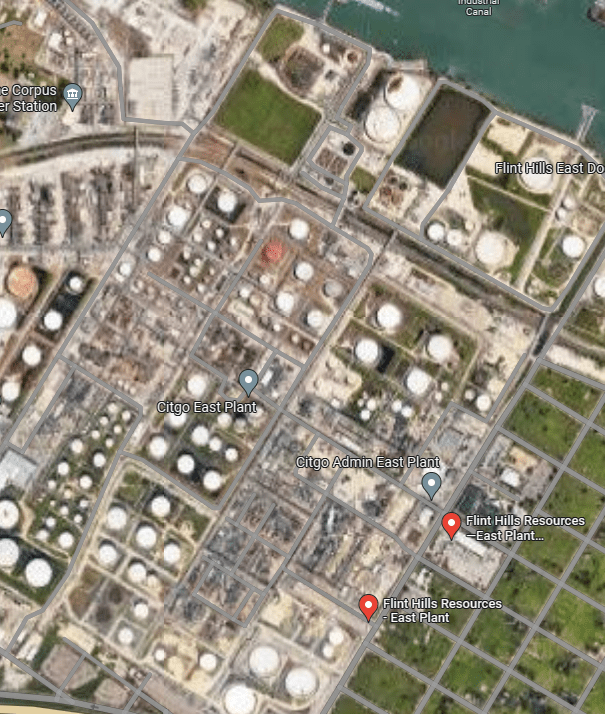

A Flint Hills Resources 343,000 barrel per day refinery in Corpus Christi, Texas, was significantly impacted by unseasonably cold weather including freezing rain.

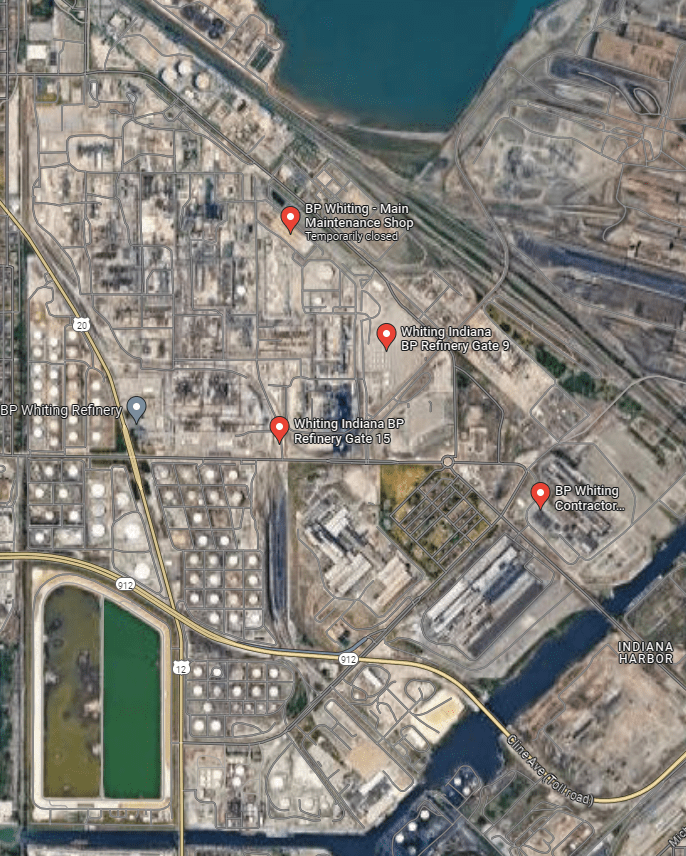

The largest refinery in the Midwest, BP’s 435,000 barrel per day refinery in Whiting, Indiana, was taken off-line by a power outage and forced a 10 % drop in refinery utilization in the Midwest the first week in January. Normally the Midwest region produces as much gasoline and diesel as it consumes. This rich local supply leads to somewhat lower prices in the region.