Trump’s ill-tempered brinksmanship and his coarse criticism of both long-term allies and old adversaries has begun to cost the US access to strategic materials. In particular, China has announced that it has banned the export of a group of metals and non-metals to the US. Specifically, China had previously imposed export controls on Rare Earth Elements (REE), gallium (Ga), germanium (Ge), antimony (Sb) and graphite (C). More recently it has included tungsten (W), tellurium (Te), bismuth (Bi), indium (In) and molybdenum (Mo) products.

In case the reader is unfamiliar with the uses of the above elements, a list of them with a short description is given below.

Many of the elements listed above are by-products from the refining of other metals like aluminum, copper, lead and zinc. Reduced production of aluminum, copper, lead and zinc will also reduce output of their accessory metals as well.

- Gallium– Primarily used in semiconductors; is used to produce the denser, stabilized δ allotrope of plutonium for use in nuclear weapons.

- Germanium– Primarily used in semiconductors; a by-product found in copper-lead-zinc ores.

- Indium– Primarily used in semiconductors or other electronic applications; it is a by-product found in sulfidic zinc (Sphalerite) and copper ores (Chalcopyrite). Indium tin oxide (ITO) forms a thin, transparent and electrically conductive layer on glass for touch-screen applications such as smart phones.

- Tellurium– A scarce element at an average occurrence 1 ppb in the crust and never the primary ore in mining. It is mostly found combined with gold as Calaverite (AuTe2 ), Sylvanite (AgAuTe4 ) or Krennerite (AuTe2 Orthorhombic gold telluride.) Tellurium has use in a large variety of applications. Unfortunately for gold miners, calaverite ore is not susceptible to cyanide extraction for gold recovery. Calaverite can be roasted and tellurium volatiles removed from the gold residues. However, commercial scale roasting of minerals is problematic in the US.

- Bismuth– Bismuth is never the primary ore in mining. It is found with lead, copper and tungsten. Broad applications across many domains. No longer produced in US. Bismuth is the highest atomic number element that is not naturally radioactive. Well, it’s half-life has been determined to be 1.9 × 1019 years which is still “pretty stable”.

- Antimony– The largest antimony mine in the world is the Xikuangshan mine in Lengshuijiang Hunan, China. This mine produces 50 % of the world’s antimony. The mine produces antimony from 2 different minerals, stibiconite (Sb3O6(OH)) and stibnite (Sb2S3).

- Molybdenum– Mined as the primary metal ore. About 86 % of molybdenum is used in metallurgy with the rest used in chemical applications. An important molybdenum mineral is molybdenite, MoS2. Important US mines are the now-defunct Henderson Mine and the now operating Climax Mine, both in Colorado and both operated by Freeport-McMoRan. The Climax Mine resides at the summit of Freemont Pass at 11,360 ft altitude and to the north of Leadville, Colorado. Molybdenite deposits can be found as far away as Questa, New Mexico, with the Chevron Questa Molybdenum mine which is now closed and undergoing reclamation as a superfund site.

- Graphite– Natural graphite arises from metamorphization of carbonaceous sediment. It can mined or produced synthetically. Graphite is the most chemically stable allotrope of carbon at standard pressure and temperature.

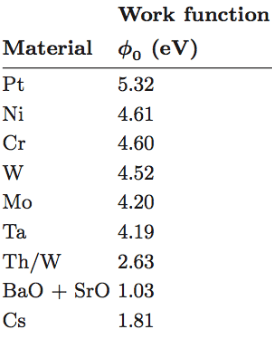

- Tungsten– Also known as wolfram (W), tungsten has the highest melting point and lowest vapor pressure of the elements. As a refractory metal, tungsten us often used in high temperature applications such as welding and for its relative chemical inertness affording high resistance to corrosion. In military applications tungsten is exploited for its combination of high density, hardness and refractory properties in projectiles and other applications. In chemical form, it is often found as a polyoxometallate anion such as WO4−2, “orthotungstate”. These polyoxometallate anions can form higher order cage structures.

All of the above elements are well established in diverse products and are a part of numerous leading-edge technologies in use today. All ores are subject to the market price of their mined and milled products. All of the elements listed above are produced in various simple but purified forms that customers will plug into their own production lines. The economics of their mine operation has a high reliance on the margins offered by their raw material costs. If the raw material supplier goes a step further and captures value-added profit margins by offering an advanced intermediate or even the final product, then the customer faces having to use the more costly value-added materials. The effect can be that they must raise prices on their product or step away from the market. This is just the old familiar path of competition.

As luck would have it, early in geologic history China won the mineral lottery when many ore-forming processes valuable ores in its present territory. We have all heard of China’s supremacy in rare earth element (REE) reserves. China eventually made the choice of halting exports of rare earth minerals as the oxides in favor of offering value added finished products instead. Business-wise, this was a smart and inevitable choice for China, but users who manufactured REE products from their imported REE raw materials were suddenly facing stiff competition from abroad.

Since this policy of China metering closely the export of REE minerals, western countries have made considerable progress locating REE deposits elsewhere. Incidentally, the same holds true for lithium deposits.

Restrictions on exports of the above elements will have a large impact on many industries in the US. My question is this: Could a better diplomatic approach to imports from China have been made?

It isn’t all bad news. Difficulties with raw material prices and availability frequently motivate users to invent a way around problematic raw materials. There is nothing like the motivation to fire up the inventive juices than to seek a work-around for a raw material supplier problem.